London, May 15th, 2012 – Overall, throughout the global defense supplier industry, 44% of C‑level respondents are ‘more optimistic’ about revenue growth for their company over the next 12 months relative to the previous 12 months. A further 31% of C‑level respondents are ‘neutral’ about revenue growth, as compared with 22% who are ‘less optimistic’ about their company’s revenue prospects.

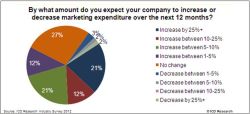

33% of C‑level respondents expect an increase in marketing expenditure of between 1% to 10% in 2012, while only 5% of respondents expect a decrease of between 1% and 10% (reference see graph below). Marketing budgets of global defense supplier industry supplier companies are expected to rise by an average of 8.8% over the next 12 months. Suppliers’ C‑level respondents plan to spend more on ‘email promotions’. For C‑level respondents, media channels such as ‘email promotions’, ‘email educational messages’, ‘webinars’, and ‘web conferencing’ are still the best way of communication and advertising.

|

| Click to enlarge |

|

| Here you can find more information about: |

C‑level executives from the global defense supplier industry expect increased levels of consolidation over the next 12 months. Of all C‑level respondents, 57% project either a ‘significant increase’ or an ‘increase’ in M&A. However, 32% of C‑level respondents expect no change in consolidation activities in 2012. The expected levels of consolidation in the industry could be due to new cost or demand pressures, repayment of debt, the potential need to meet new compliance procedures, quick access to new markets, business expansion, and an increase in market share. Additionally, suppliers reveal that they will increase capital expenditure towards‘new product development’ and ‘machinery and equipment purchase’over the next 12 months.

Global defenseindustry respondents identify the Middle East to be the most important region for growth among emerging markets, followed by India, China, and Brazil. Defense expenditure across the Middle East is expected to grow by 14% in 2011–2016, with Saudi Arabia and the UAE emerging as the key spenders. The majority of the region’s military expenditure is aimed to upgrade existing equipment and augmentingdefense capabilities, and these measures have primarily been adopted to counter the increasing threat from nuclear capable countries, homeland security concerns, and to protect critical infrastructure.

On the other hand, according to 44% of C‑level respondents, South Korea is expected to project the greatest demand for defense products and services in 2012–2013. Additionally, 40% of C‑level respondents chose Singapore, Taiwan and Hong Kong, and 31% chose USA, as their preferred investment destinations.

About ICD Research

ICD Research is a full-service global market research agency and premium business information brand specializing in industry analysis in a wide set of B2B and B2C markets. ICD Research has access to over 400 in-house analysts and journalists and a global media presence in over 30 professional markets enabling us to conduct unique and insightful research via our trusted business communities. Through its unique B2B and B2C research panels and access to key industry bodies, ICD Research delivers insightful and actionable analysis. The ICD Research survey capabilities grant readers access to the opinions and strategies of key business decision makers, industry experts and competitors as well as examining their actions surrounding business priorities.

About Strategic Defence Intelligence

This report is one of a series available to subscribers of our premium research platform, Strategic Defence Intelligence. Strategic Defence Intelligence provides a stream of continuously updated customer and competitor intelligence, as well as detailed research reports providing an unrivalled source of global information on the latest developments in the defence industry.

Strategic Defence Intelligence’s unique monitoring platform tracks global defence activity for over 2,500 companies and 65 product categories in real time and in a highly structured manner, giving a comprehensive and easily-searchable picture of all defence industry activity. The site features: daily updated analysis, comment and news, company and customer profiles, defence spending, tenders and contracts, product and technology intelligence, a research and analysis database providing access to industry and competitor reports to enable business and market planning, and fully customizable tools, including instant personalized report generation and custom alerts.

von

von